Rahma Aulia Sidik

Rahma Aulia Sidik

Strategies for Risk Mitigation in Indonesian P2P Lending Platform

Bisnis | 2023-12-31 21:31:47

In recent years, Financial Technology (FinTech) has emerged as a revolutionary force in the financial sector, particularly in Indonesia. Peer-to-Peer (P2P) financing, notably for Small and Medium Enterprises (SMEs), is one sector where this influence is visible. As the FinTech business expands, it comes with the new challenges and possibilities.

PT Alami, a fintech company, has revolutionized the Islamic financial industry in Indonesia by providing digital financial solutions that align with Islamic principles. They offer a platform for investors to invest without violating Islamic principles, and engage with the community to optimize their financial potential.

PT Alami offers a financial solution that combines digital innovation and Shariah principles, utilizing the most recent technological advancements. The public can now engage in the Sharia financial ecosystem through PT Alami's transparent and accountable approach, allowing them to manage their finances sustainably and in line with their religious beliefs. People who wish to maximize their financial potential in accordance with Sharia principles can benefit greatly from PT Alami initiative, which has helped to increase access to Sharia finance services in Indonesia.

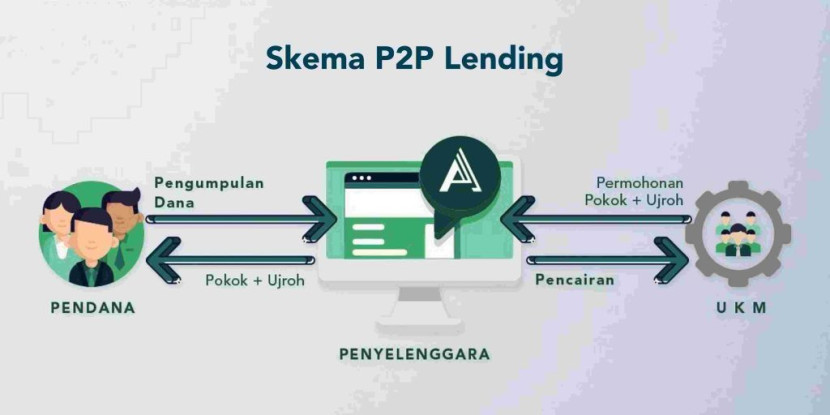

Scheme in ALAMI P2P:

1. Candidate recipient of funding is having a project that has been completed but has not paid its invoice from the payor (project provider) and needs capital for its operational needs.

2. Candidate recipients of financing (in this case usually UMKM, depending on the policy of each P2P lending organizer) apply for financing to the organizer (one example of the product is invoice financing) with some documents that will be subsequently analyzed in terms of the financing risk submitted.

3. If the submission of financing to the organizer is approved, the financing will be transferred to the platform system or listing of the P2P lending organizer which will subsequently be funded by the financers or lenders.

4. If the amount of funding has been collected, the nominal funding will be disbursed or channeled to the funding recipient (UMKM or who applies for financing to the P2P lending organizer) and subsequently the beneficiary will make a reimbursement or repayment to the financing provider or lender at the time of expiry.

5. Approaching the due date, the payor will repay the invoice submitted to the organizer for reimbursement to the funder along with the benefit obtained after the financing period.

In P2P lending, financing risk refers to the possibility of financial loss due to borrowers' failure to repay their debts. Factors like as market instability, economic downturns, and operational issues can all have a substantial influence on SMEs' repayment capacities. A comprehensive review of the economic situation and particular challenges encountered by SMEs borrowers is the first step in minimizing financing risk.

For PT Alami, a key player in Indonesian P2P lending sector, Sharia compliance is essential. Sharia risk emerges when financial transactions do not correspond to Islamic norms. This involves avoiding usury (riba) and making ethical and socially responsible investments. Sharia risk mitigation is not simply a legal requirement, but also a commitment to ethical financial practices.

According to a research conducted by Anugrah and Halifa (2023), the following are strategies for PT Alami risk mitigation:

1. Character Assessment: In order to ensure responsible financing use, Alami examine the character of SMEs requesting finance by visiting their business locations, confirming documentation, and completing KYC.

2. Payment Ability Analysis: Alami evaluates SMEs' financial conditions based on reports from the last three periods, scrutinizing cash flows, and examining financial documents to assess payability, including liquidity, solvency, debt coverage, profit margin, and other ratios.

3. Payment Fund Safeguarding: To mitigate the risk of misuse by SMEs by utilizing Virtual or escrow accounts, preventing unauthorized withdrawals. Post-dated cheques and return guarantees further secure payment.

4. Payor Evaluation: Ensuring that SMEs only engage with payors meeting specific criteria, including good reputation, financial stability, legal compliance, and positive environmental impact. Detailed criteria for acceptable payors are outlined, emphasizing factors like business type, financial situation, legal and environmental standing, diligence through third-party sources, and a minimum income threshold.

5. Legal Risk Mitigation: Legal aspects are addressed through notarized financing agreements with authorized SMEs, supplemented by Personal Guarantee or Company Guarantee as a secondary recourse for risk containment.

Effective risk management in P2P lending to SMEs in Indonesia, as exemplified by PT Alami, necessitates a combined focus on finance and Sharia concerns. PT Alami establishes a pattern for sustainable and responsible financial operations in the dynamic FinTech sector by employing extensive due diligence, diversification methods, and technical advancements. The case study provides a significant resource for industry participants and regulators attempting to find a difficult balance between financial innovation and ethical issues in the Indonesian P2P lending sector.

***

Co-Author: Yaga Tria Wandani Sukma

Disclaimer

Retizen adalah Blog Republika Netizen untuk menyampaikan gagasan, informasi, dan pemikiran terkait berbagai hal. Semua pengisi Blog Retizen atau Retizener bertanggung jawab penuh atas isi, foto, gambar, video, dan grafik yang dibuat dan dipublished di Blog Retizen. Retizener dalam menulis konten harus memenuhi kaidah dan hukum yang berlaku (UU Pers, UU ITE, dan KUHP). Konten yang ditulis juga harus memenuhi prinsip Jurnalistik meliputi faktual, valid, verifikasi, cek dan ricek serta kredibel.